In Short : At the World Economic Forum, global leaders engage in discussions about implementing a worldwide carbon tax. The debate revolves around the potential establishment of a comprehensive and unified approach to taxing carbon emissions to address environmental concerns on a global scale.

In Detail : Leaders discussed a potential global carbon tax during a panel discussing the economic outlook at the World Economic Forum

World leaders heard a call for a global carbon tax as a solution to climate change during a panel discussion at the World Economic Forum in Switzerland this week – a proposal that elicited a response from Saudi Arabia’s finance minister.

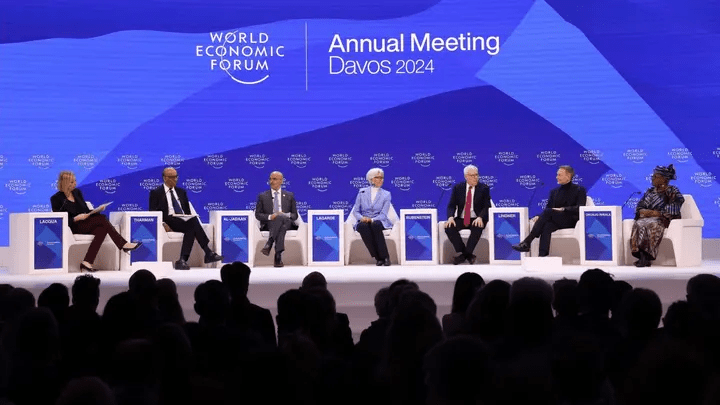

The WEF attendees’ discussion of a carbon tax came up during a panel on the global economic outlook on Friday in the Swiss alpine resort town of Davos, which hosts the annual conference of political leaders and business titans from around the world. Singapore President Tharman Shanmugaratnam made the suggestion as fellow panelists Ngozi Okonjo-Iweala, general director of the World Trade Organization, and Christine Lagarde, president of the European Central Bank, listened.

“There is no realistic solution to the climate transition that does not involve a globally coordinated system of carbon taxes,” said Shanmugaratnam.

“There’s a perception that it’s unjust, it’s unfair, it will lead to inflation,” Shanmugaratnam said. “In fact, quite the contrary. If we don’t do this, the countries that will suffer most ultimately are the developing countries. They’re going to be the worst affected by climate change.”

“What we need is a system of carbon taxes coupled with subsidies for vulnerable households and a stream of funding for the developing world to allow them to engage in investments and mitigation and adaptation that allows them to keep growing. And that’s a real opportunity. It’s a fair solution, and it’s the only realistic solution and we can’t keep ducking it,” he continued.

Mohammed Al-Jadaan, finance minister for Saudi Arabia, responded to the Singaporean president’s comments, saying he agreed that the “risks from climate change are real and we should work all together to find solutions that would help the planet and the livelihood of people.”

Al-Jadaan noted that in the wake of the Paris climate accord in 2014, developed countries committed $100 billion annually to developing countries to address climate change and transition out of carbon-intensive energy, but that “almost zero” has been delivered.

“I can understand Mr. President’s enthusiasm for a carbon tax and how it may change the equation, but then he linked it to two things: Subsidies to those who are in need – I agree that whenever you raise costs on your community or others you need to look out for the less fortunate and provide a social safety net. Agreed.”

“The second caveat Mr. President said is that we need to find a way that we channel part of that to low-income countries,” he added. “We tried that and it failed now, so trying something else similar to what you have tried before and expect different results, it’s very difficult. There is a lot of political resistance from developed nations – politically, internally I mean we have heard just now some of the comments. So to say that we will put a tax but then that we will redirect some of that to low-income countries is going to be very difficult politically, extremely difficult.”

“I would just remind ourselves that while we are enjoying the heated conference place here, there are over 600 million people in Africa that have no basic electricity. Not intermittent, basic. Absolutely no electricity,” Al-Jaddan said.

“So to say to them, go and eat cake, why are you looking for bread, is hypocrisy in my opinion. They have their own endowment, we should help them get that endowment from under their feet – gas, for example. Let them fuel their own transition,” he explained. “Allow them to use their own endowment, help them to use their youth, empower their youth, reskill their youth, train their youth. That is what is really going to change Africa and other low-income countries.”

Christian Lindner, Germany’s finance minister, responded, “I hope that nobody tells my coalition partners and my colleagues and cabinet that we are here considering raising taxes. It would cause huge problems for me domestically.”

He added while he shares the idea of “fighting global warming by ambitious action,” he thinks that a better alternative would be a carbon market. For example, he explained that such a market would enable a country like Germany to invest in renewable electricity production in Africa as part of compensation for the German steel industry’s emissions.

“We should ask the OECD to develop a common framework for a global carbon market as they did successfully on the global minimum taxation effort,” Lindner explained.