Tax credits may soon help jump start projects in the Midwest designed to fight climate change by capturing carbon dioxide emissions. However, the cost to taxpayers remains uncertain.

ADRIAN FLORIDO, HOST : A major component of the Biden administration’s plan to fight climate change are tax credits that prompt companies to find ways to end CO2 emissions that are heating up the planet. Last year’s Inflation Reduction Act set aside $250 billion to jumpstart the country’s clean energy transition. Whether that will be enough or effective is still a huge question. Harvest Public Media’s Juanpablo Ramirez-Franco reports.

JUANPABLO RAMIREZ-FRANCO, BYLINE: Walking between two rows of fermentation drums at the Adkins Energy ethanol plant in northwest Illinois, Jason Townsend shows me a pipe overhead.

And the pipe is that one?

JASON TOWNSEND: Way up top.

RAMIREZ-FRANCO: Townsend has worked at the facility for two decades. He says the pipe emits something like 175,000 U.S. tons of CO2 into the atmosphere a year.

TOWNSEND: You see, it’s running along the catwalk up there in between the two tanks.

RAMIREZ-FRANCO: Adkins Energy is in the beginning stages of piloting a new technology that would capture CO2 coming out of that pipe. It would turn it into green methanol, an increasingly popular biofuel. The plant’s general manager, Bill Howell, says it’s a big investment.

BILL HOWELL: And so the question is – how much risk can companies assume in the early stages in order to participate in that developing market?

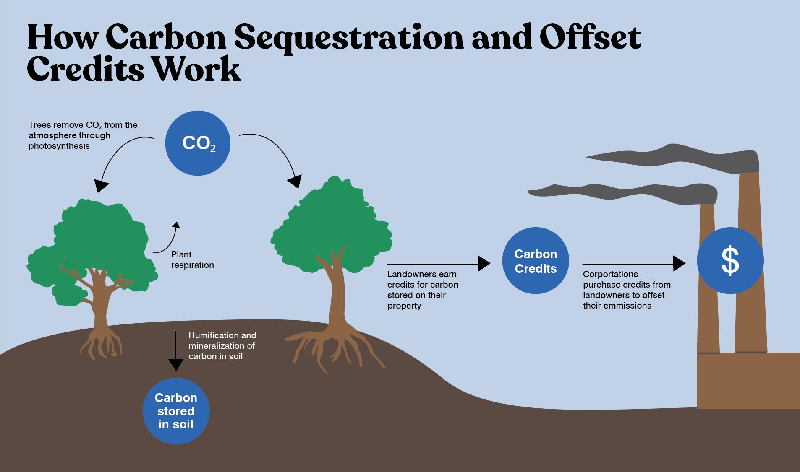

RAMIREZ-FRANCO: The Inflation Reduction Act and the Bipartisan Infrastructure Law, both passed last year, are attempting to answer that question. Together, they’ll provide hundreds of billions of dollars over the next decade to jumpstart the clean energy transition, in part through new and revised tax credits. The Department of Energy’s Noah Deich says they’re designed to encourage consumers and private enterprise to switch to newer, greener technologies like carbon capture.

NOAH DEICH: They help essentially put the thumb on the scale to make technologies that might be a little bit more but are zero emissions today, something that’s cost-effective here and now.

RAMIREZ-FRANCO: Cost-effective because the Inflation Reduction Act expands the use of uncapped tax credits, like the 45Q. Instead of paying $45 per ton of CO2 captured and permanently sequestered underground, the new law almost doubles that. It pays even more if gas is removed directly from the air. Government officials estimate that the 45Q credits will cost taxpayers upwards of $3 billion over the next nine years. However, Neil Mehrota, the assistant vice president and policy adviser at the Federal Reserve Bank of Minneapolis, says taxpayers could be on the hook for even more.

NEIL MEHROTA: They’re uncapped, so the ultimate takeup just depends on how much commercial viability and interest there is in trying to pursue carbon capture projects.

RAMIREZ-FRANCO: So Mehrota co-authored a report that found that the CO2 tax credits could cost somewhere in the ballpark of $100 billion over the next 10 years, or 30 times what the government estimated. And there’s concern about whether that’s money well spent. Steve Ellis is the president of Taxpayers for Common Sense. He says an analysis by federal agencies found that 10 companies claimed over a billion dollars in 45Q tax credits previously.

STEVE ELLIS: And when they did the analysis, they found that $894 million worth of those credits – so almost the entire amount, you know, nearly 90% – did not comply with EPA guidance.

RAMIREZ-FRANCO: The Treasury Department and the IRS are expected to release revised guidance on tax credits later this year. The DOE’s Deich says tax credits may be expensive, but they’re worth it.

DEICH: The alternative is emissions going into the air, making climate change worse.

RAMIREZ-FRANCO: And that could be even more costly. For NPR News, I’m Juanpablo Ramirez-Franco in Lena, Ill.

FLORIDO: Erin Jordan of the Cedar Rapids Gazette contributed to this story as part of a collaboration with Harvest Public Media.