How central bankers got it spectacularly wrong on net zero inflation

Experts fear the elite’s obsession with going green will cause prolonged pain for millions

It was presented as a new utopia. Clean abundant energy, available to all. Millions of new jobs, flourishing economies and a cleaner, greener world. And all while cutting bills and freeing up money spent on light and heat to be used elsewhere.

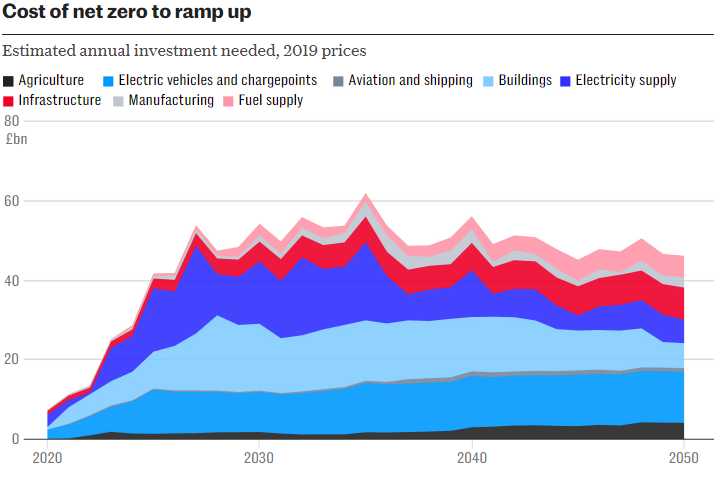

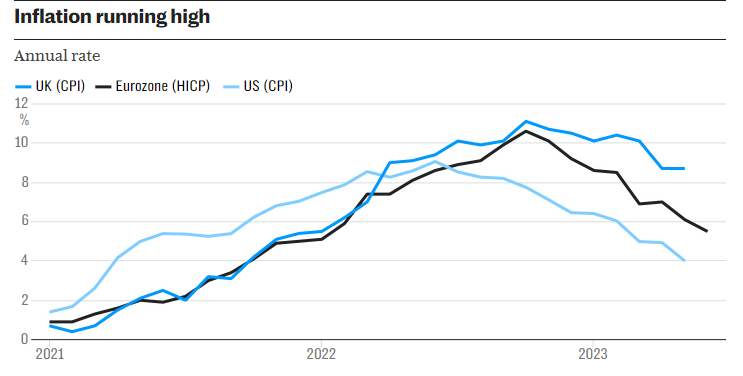

However, as the transition to net zero speeds up, and wind and solar power replace oil and gas, it is becoming increasingly clear that prices are not coming down fast. Instead experts fear that going green will make the inflation crisis worse – in a fresh blow to the credibility of a string of central bankers who have predicted the opposite.

“The green transition will be expensive and, if tax collection does not keep up with increased spending, there will be an expansionary fiscal impact that could add to economic demand relative to supply, and thereby inflation,” says George Buckley, UK chief economist at Nomura.

While investment helps to drive innovation and increase productivity, which helps to lower price pressures, it also puts “an increasing strain on limited mineral supplies”, he adds.

The cost of this should not be underestimated. Wind turbines, solar panels, electric vehicles and batteries are all made with rare earth elements and critical metals.

All of this is likely to confound the central baking elite, who have called for a swift end to fossil fuels.

“The net zero transition is disinflationary,” Mark Carney insisted in a speech last year. The former governor of the Bank of England doubled down on this assertion last month, admitting that while prices would probably rise for about a decade in pursuit of net zero, going green will ultimately help to keep inflation low and stable.

“Clean energy is cheaper. It’s cheaper today, and it will be cheaper still tomorrow, and it will be less volatile than the system that we have,” he told The Telegraph in an interview.

Christine Lagarde, president of the European Central Bank, agrees. “Extreme weather events can damage infrastructure, ravage harvests and disrupt supply chains,” she said in a speech last year.

“This can push up prices for key products and thereby fuel inflation, making it tougher for us to keep prices stable. By contrast, reinforced efforts to shift our energy supply towards more economical renewables should ultimately help to slow inflation.”

However, Nomura has suggested that pressing ahead will make the Bank of England’s 2pc inflation target “increasingly difficult to achieve” – in part because of net zero.

UK inflation already stands at 8.7pc and is not expected to return to the Bank’s 2pc target until 2025. Faster action on climate “comes with a cost”, Nomura analysts say.

Nomura says piling levies on consumer bills, promoting the use of greener forms of energy and increased investment will all push up prices for decades to come.

Azad Zangana, senior European economist at Schroders, said that the challenge will get worse as an increasing number of nations go green. Going too fast risks another supply shock for the global economy, and one that could substantially push up prices.

“As more countries around the world start to go down the energy transition route, there will be a greater demand for some very difficult to find commodities, like rare earth elements and various other forms of metals that are in short supply right now. So as more countries decide to go down this road, the cost of transition will start to rise exponentially,” he says.

“They’re called rare earth elements for a reason.”

Base metals will also be needed. For example, the International Energy Agency (IEA) estimates that building an offshore wind plant needs seven times more copper than a gas plant.

Zangana highlights that many countries are waking up to the fact that demand for their natural resources will only keep growing.

Chile, which holds one of the largest lithium reserves on the planet, announced in April that it will nationalise the industry, giving the government control of supplies – and prices. They’re not the only ones. Mexico nationalised its lithium deposits last year, and Indonesia banned exports of nickel ore, a key battery material, at the start of the decade.

“To the extent that the supply of these [minerals and metals] is relatively inelastic, increased demand may drive up global costs substantially,” says Buckley.

There’s also the issue of how the transition will impact different groups in society. “Whenever there’s higher inflation, it always hits those on lower incomes and people with less wealth regardless of the cause,” Zangana says.

While some people can afford electric cars and shoulder extra levies on their bills, those who cannot will either be left counting the costs of a carbon tax on their fuel or applying for more state handouts to cope.

“Unfortunately, this is something that could contribute to a greater inequality going forward,” Zangana says.

Paul Fisher, a senior research fellow at King’s College Business School, says many people are at risk of being left behind.

“You may need to shift people from one sector to another, and it may not be the same people,” he says.

“So for example decades ago lots of coal miners lost their jobs, and some never got jobs anywhere else. So the government is obliged to step in and do something to support those communities. If they’re 50 or 60 years-old, they may not even find another job. And so you can get the dislocations that happened in the 1980s: higher unemployment, people losing manufacturing jobs, and they aren’t really suitable to go into other sectors.”

Despite this, Fisher, a former central banker, is optimistic. Like Zangana, he believes that there is no alternative to net zero.

“If you don’t have the transition, the outcome for unemployment, and the economy is much, much worse,” says the ex-Bank of England veteran.

“The volatility is going to be much more inflationary, arguably, because you won’t be able to grow and ultimately the economy will crash.

“We’re still dependent at the moment on importing fossil fuels from non-democratic countries. And if you look back over history, this has generated price spikes for 50 years. And it will continue to do so unless we can wean ourselves off fossil fuels.”

Fisher says governments around the world will face tough choices to protect the planet while preserving votes, a dilemma that goes well beyond central banks, inflation and interest rates.

“Climate change is a long-term problem, but we live in democracies with short term horizons,” he says.

“I remember during the financial crisis, somebody said: “Well, we know what to do to rescue the financial system, we just don’t know how to get elected afterwards. It’s the same with climate change. Politicians just don’t know how to get elected if they push this through.”

In the long run, net zero may indeed bring down prices. But before then, the politicians – and central bankers – face the challenge of explaining to the public that their utopian rhetoric on green energy is falling short of reality.