Your business doesn’t need to be captured by reforms to the Safeguard Mechanism (SGM) to need a carbon credits strategy.

In brief

- SGM reforms will support cost-effective abatement, establish a visible carbon price and drive demand for Australian Carbon Credit Units.

- EY Net Zero Centre analysis suggests ACCU prices could double to around AU$75 (in real dollars) before 2035.

- As the market changes gears, business leaders must rethink their approach to carbon offsets.

The SGM covers around 215 of Australia’s largest greenhouse gas-emitting industrial facilities, including oil and gas producers, mining and heavy industry. These facilities are responsible for around 28% of Australia’s emissions.

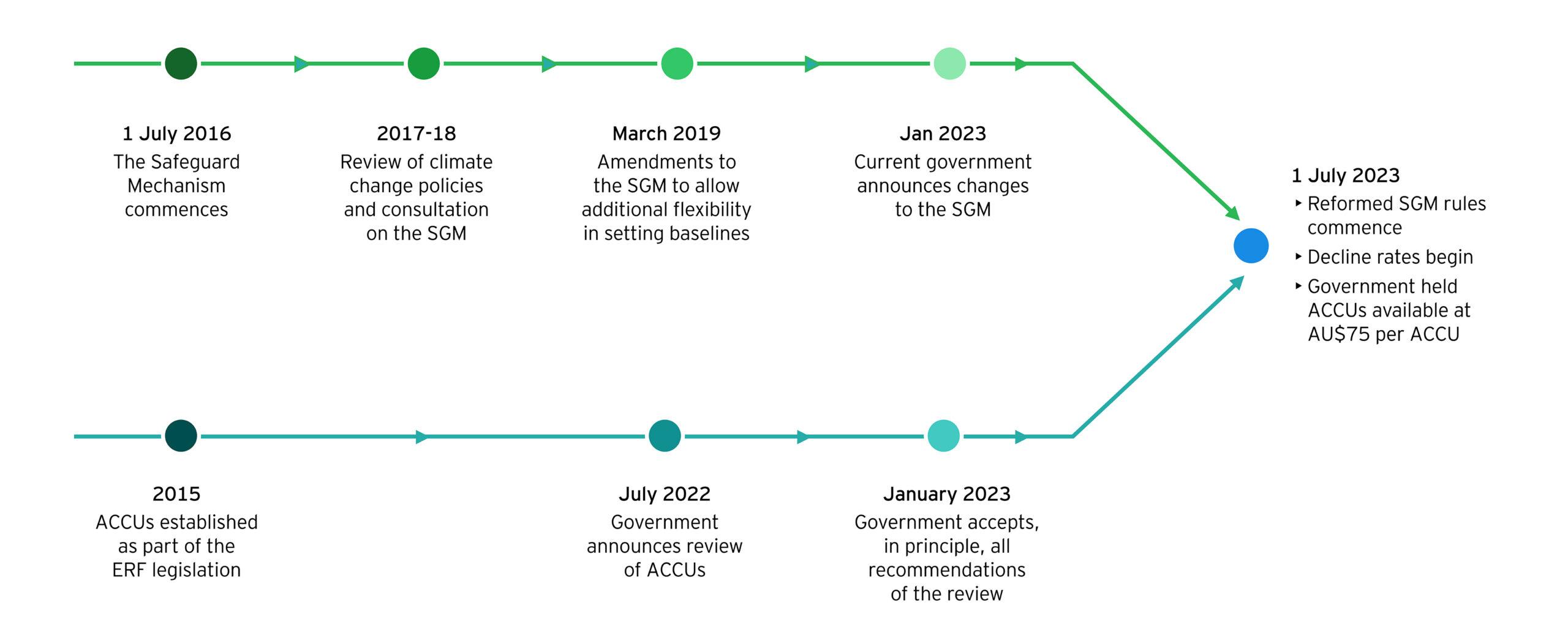

Under the previous SGM policy framework, there was little incentive for these facilities to reduce their emissions, even where costs were relatively low. However, reforms to the SGM that were introduced on 1 July 2023 will motivate covered facilities to find and implement abatement opportunities.

The SGM will now set ‘baselines’, or limits, for the direct emissions from each facility that are much closer to current levels of emissions, and will reduce this baseline each year. Australia’s most emissions-intensive facilities are now on a net zero trajectory, with a default obligation to reduce their greenhouse gas emissions by an average of 4.9% each year to 2030.

Facilities that do not meet this reduction are required to buy either Safeguard Mechanism Credits (SMCs) or Australian Carbon Credit Units (ACCUs) to cover the volume of carbon emissions that exceed their baselines.

At the same time, an independent review of ACCUs has confirmed the integrity of Australia’s carbon credit market. The review panel, chaired by Professor Ian Chubb, concluded that the ACCU scheme was “fundamentally well-designed” but made several recommendations to improve the system, all of which have been accepted in principle by the Australian Government.

The ACCU market is now poised to underpin Australia’s carbon policy framework for large industrial emitters until at least 2030, and likely much longer.

The SGM and ACCU initiatives converge

Three findings for every business leader to consider

In June, we noted that the price of Australian Carbon Credit Units could double before 2035, coming in just below the Australian Government’s cost containment measure.

Since then, the EY Net Zero Centre has undertaken additional scenario modelling and analysis to understand the impact of this policy on Australia’s carbon credit market. We find Australia’s carbon market could deliver an additional 20 million units annually by 2035, up from 17 million units in 2022.

Our new report, Changing Gears: Australia’s Carbon Market Outlook 2023 , dives deep into the possibilities out to 2050 – but there are three findings that every business leader should consider.

1. SGM reforms will drive real abatement

Our central estimate finds abatement will rise to 43 million tonnes per year by 2035, accounting for around 50% of compliance requirements under the SGM. Oil, gas and coal projects are likely to do much of the heavy lifting and deliver around 90% of emissions reductions in the short-term.

2. Low-cost opportunities are available now, but not for long

SGM facilities could have more than 40 million tonnes of annual abatement potential available at under AU$50 per tonne. Most of this can be met through efficiency programs and by addressing fugitive and vented emissions.

But by the early 2040s, we anticipate most of the lower cost abatement opportunities will be realised and options for further abatement under AU$50 per tonne will be largely exhausted.

3. Australia’s carbon price is set to double, at least

Market clearing prices for ACCUs will rise under all the plausible scenarios modelled by EY. Our central estimate sees prices doubling to around AU$75 (in real dollars) before 2035.

The plausible range of prices beyond 2035 is very wide – from between AU$65 and AU$125 per ACCU – and the unknowns numerous. What we do know is that the longer SGM facilities delay abatement the more rapidly prices will rise.

What can business leaders do next?

The ACCU market is relatively young and the reforms are new. Market participants and observers have minimal history in these market arrangements to guide expectations and forecasts. The market’s evolution and future dynamics will depend on project outcomes, demand patterns, policy developments, and the pace and pattern of technology costs and options.

Every leader will need a clear decarbonisation strategy that acknowledges the ability of credits to create value and support thriving businesses in a rapidly changing world. Where do business leaders begin?

Set a business strategy that responds to business risks, stakeholder pressures and abatement options

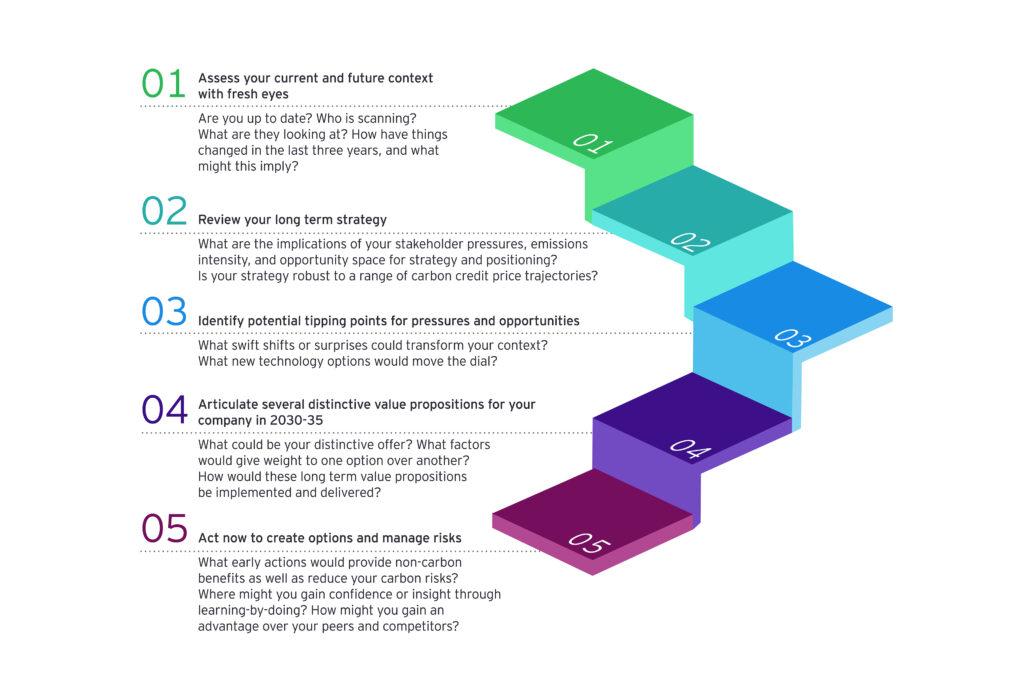

The EY Net Zero Centre has developed a diagnostic framework, with five carbon postures, to help businesses identify the most appropriate emissions reduction response.

Consider carbon credits to support earlier and more ambitious commitments, and to smooth the net zero transition

High-integrity carbon credits are a valuable tool in the abatement toolkit. While their use depends on the business context and strategy, we find they can support substantial cost savings. In fact, not using ACCUs would result in total abatement costs being around twice as high in 2035.

Engage early to prosper through the climate transition

The balance of forces favours the emergence of more efficient markets trading high-integrity carbon credits through a small number of exchanges that are linked to multiple registries in a coherent global framework. This is a future state of the world that business leaders must incorporate into their strategic planning.

Five key steps for businesses to action to prepare for a low carbon world

The near-term strategies of SGM facilities and other market participants are uncertain and consequential. Long-term, technology developments could be significant. However, policy choices are likely to have larger potential consequences beyond 2035.